Taxes

In Invoice Manager 2.1 we have completely redesigned the tax system, to offer a more flexible and powerful tax management to your accounting.

Define your own taxes

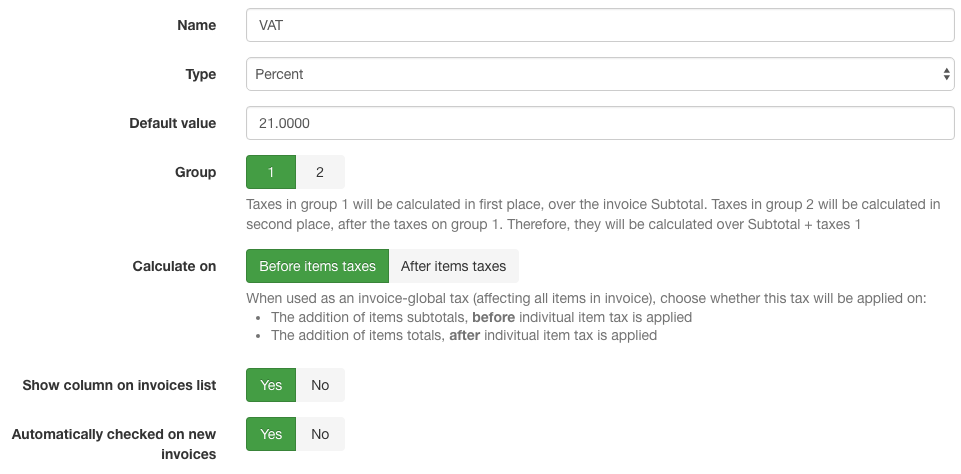

When you create a new tax, you can set its name, its type (static or percentual) and its default value. You can also define when you want this tax to be applied on the invoice (ordering and "calculate on"), plus other details. This is how defining your taxes looks like:

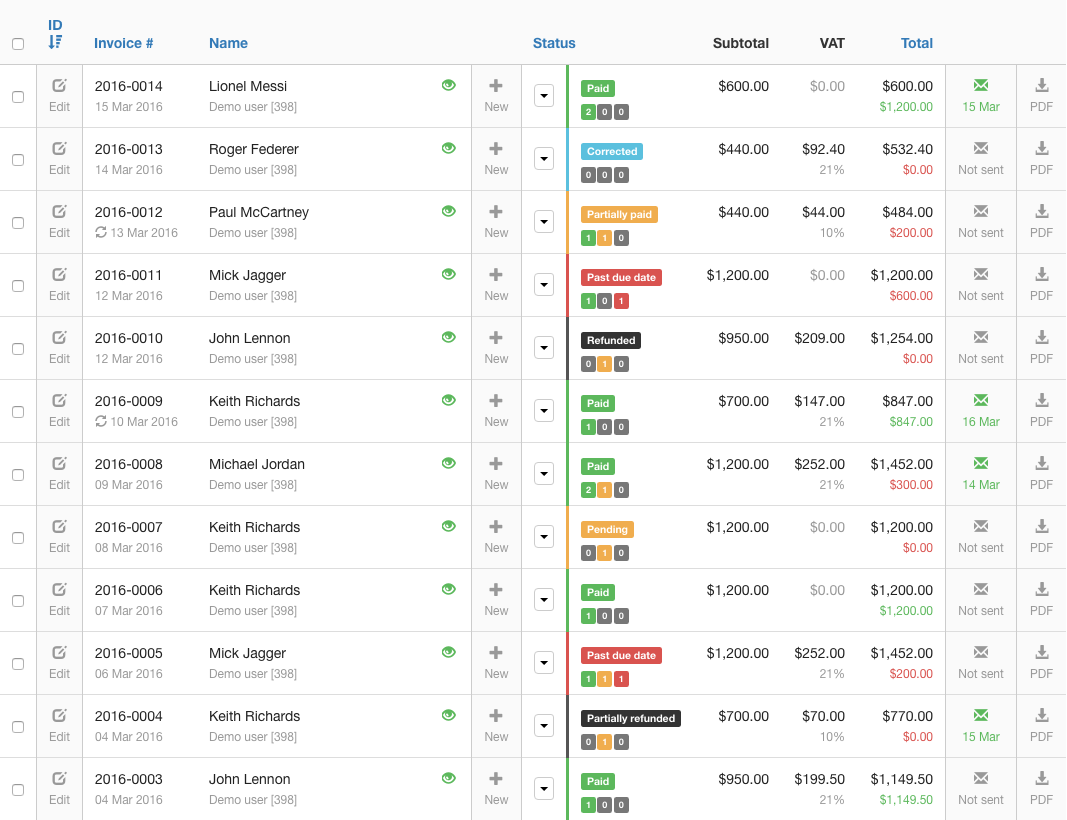

You can also use a very useful feature that allows you to display that particular tax on the main invoices list view in the administration area. This way, you can have as many extra columns as you want in this view, so you can have a lot of information on your invoices and your finances with justy one quick look.

This feature adds some very interesting and comprehensive bookkeeping features, to keep a record all of your income and expenditure, and report on the data. You can see, for instance, you much VAT you have collected.

Different group taxes

Starting on Invoice Manager 1.2, we've added a very handful feature to our Tax system that make it even more versatile. Now you can define when you want a tax to be applied: on the first place, just after the invoice subtotal is calculated, or in second place, after other taxes have been added. This is very useful for taxation systems like the Canadian tax system, where you need to add the country tax and then the region tax, which is applied in second place.

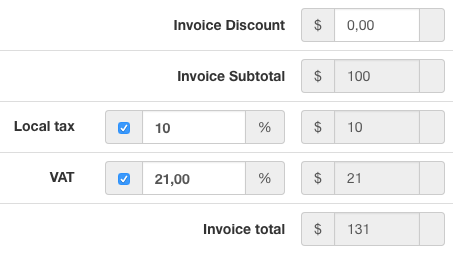

Let's make an example with some numbers: imagine you have an invoice whose Subtotal is $100. In your system, you have defined 2 taxes. One is 21%, the other is 10%.

Case 1

If both taxes are defined as "group 1 taxes", they will be calculated using the Subtotal as a reference. Therefore, the actual value for each tax will be 21% of $100 = $21, and 10% of $100 = $10, so the total on your invoice will be $100 + $21 + $10 = $131.

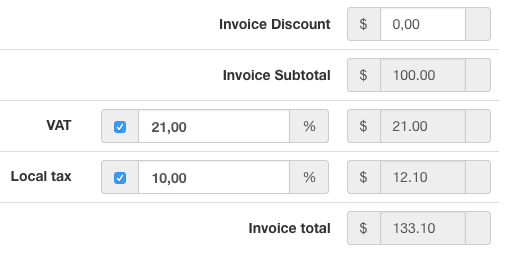

Case 2

In this case, our 21% tax is defined as a "group 1 tax", but our 10% tax is defined as a "group 2 tax". The actual value for the first tax will still be $21, but in this case the second tax of 10% is not calculated over $100, but over $121 instead (which is the addition of subtotal plus tax one). Therefore, the value for this tax in this case will be 10% of $121 = $12,1, and that will make the total of the invoice be $133,1

Different taxes for individual items in invoice

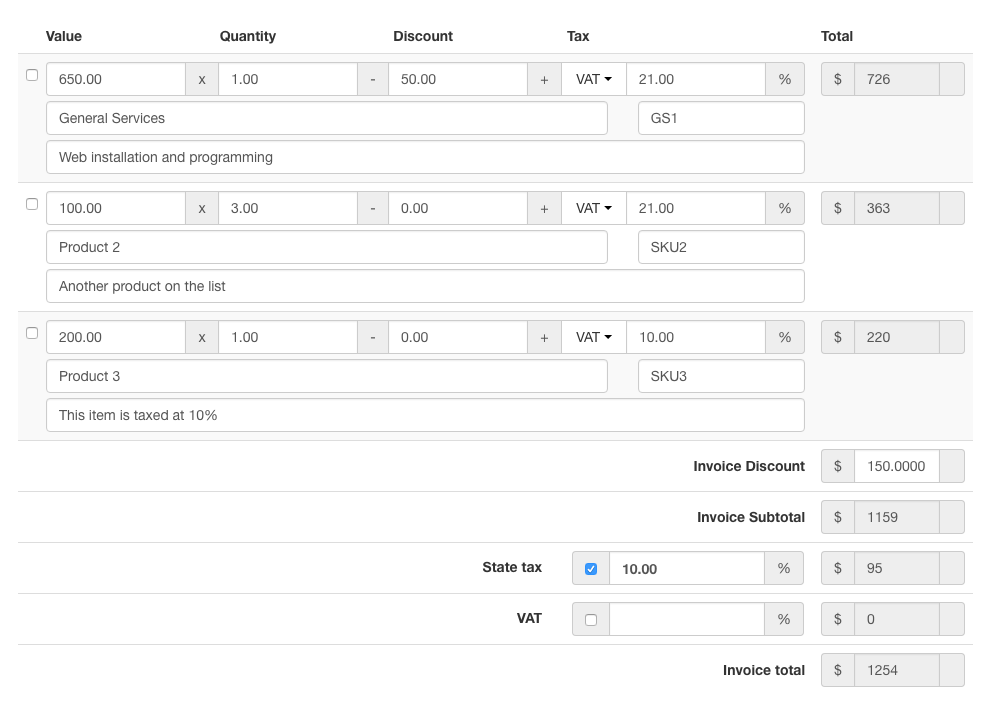

Besides all the functionality described above, starting in Invoice Manager 2.1 you can define a tax for each item individually.

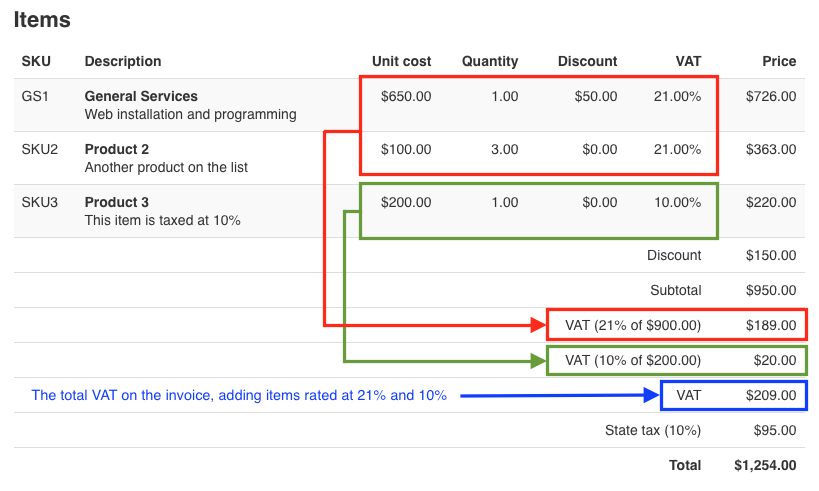

The real power

What's most interesting about the tax system is it's versatilily and the possibilites it offers. The real power relies in the fact that you can have taxes on INDIVIDUAL items, even different rates, and still show those values in the totals of the invoices, in a grouped way.

Imagine an invoice where you have items taxed at 21% and also items taxes at 10%. And on top of that, you have a global tax affecting all items. You can achieve this (and much more, and more complex!) in Invoice Manager

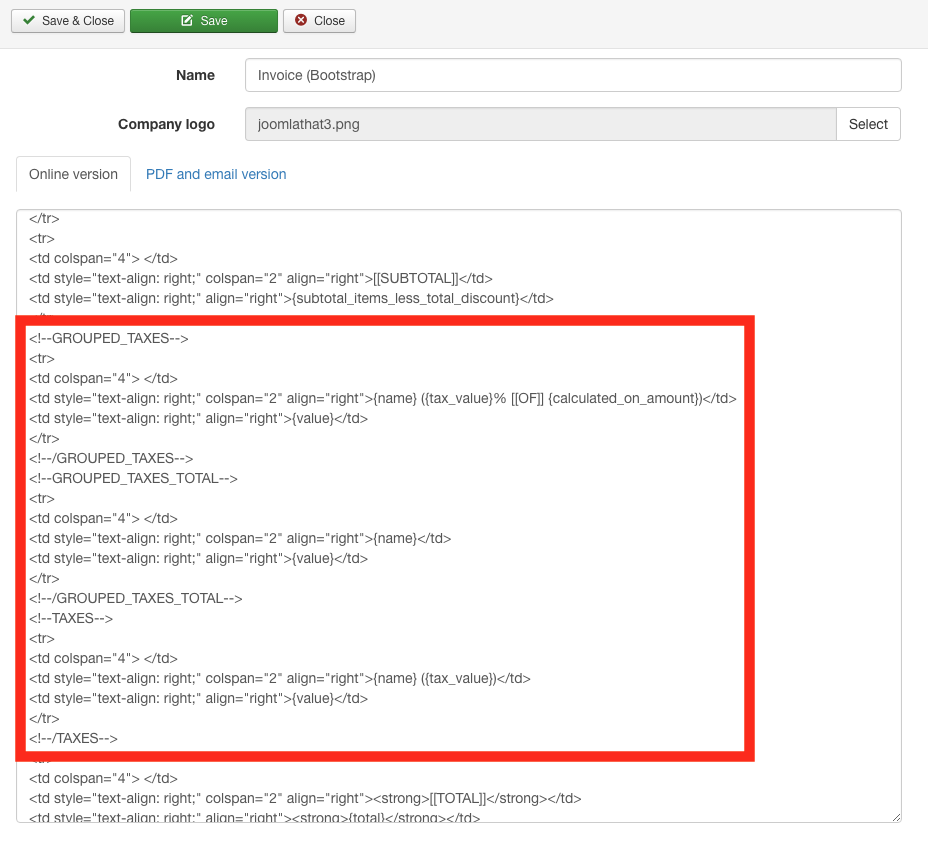

When showing the tax information in your invoice template, you can do it in a million different ways. You can show the total for each tax you have (for instance, VAT in this example), in a single line, or you can show a different line for the addition of "total items taxed at X%", or you can show both.. or none.